- SeedBlink held an insightful webinar dedicated to portfolio strategies, instruments, and diversification for investors

- The event took place online via Zoom on September 24th 2024

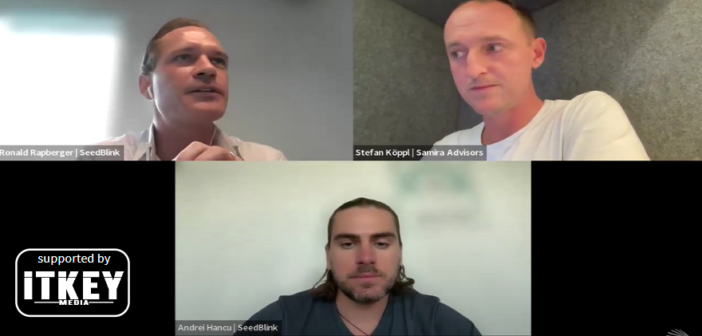

- The guest speaker was Stefan Köppl of Samira Advisors

On September 24th, the established Romanian co-investment platform SeedBlink is holding a webinar on strategies for startup investors, portfolio building, and investment instruments. SeedBlink’s regional manager DACH Ronald Rapberger moderated the webinar, and the speakers were the company’s general counsel Andrei Hâncu and tech M&A lawyer Stefan Köppl.

Speakers and Topics

Stefan Köppl is an accomplished tech M&A lawyer with over ten years of experience spanning venture capital, strategy consulting, and mergers and acquisitions. As a co-founder of Indie Campers, now the largest campervan rental company in Europe, he played a pivotal role in its growth before transitioning to advisory positions at Samira Advisors. He holds a Master’s Degree in Management from ISCTE Business School in Lisbon and has contributed to academic research through several published papers. Specializing in the information and communication technology sectors, Mr. Köppl has overseen numerous successful transactions throughout his career.

Stefan Köppl is an accomplished tech M&A lawyer with over ten years of experience spanning venture capital, strategy consulting, and mergers and acquisitions. As a co-founder of Indie Campers, now the largest campervan rental company in Europe, he played a pivotal role in its growth before transitioning to advisory positions at Samira Advisors. He holds a Master’s Degree in Management from ISCTE Business School in Lisbon and has contributed to academic research through several published papers. Specializing in the information and communication technology sectors, Mr. Köppl has overseen numerous successful transactions throughout his career.

Andrei Hâncu, SeedBlink’s general counsel, is a corporate law expert specializing in mergers and acquisitions. At SeedBlink, he provides legal guidance to startups, supporting them through their growth and fundraising phases, with a particular focus on compliance and equity crowdfunding. In addition to his corporate role, Mr. Hâncu is dedicated to legal education, frequently serving as a speaker and trainer at seminars and workshops on Law. A graduate of the University of Bucharest, he is also an active member of the Bucharest Bar Association.

Andrei Hâncu, SeedBlink’s general counsel, is a corporate law expert specializing in mergers and acquisitions. At SeedBlink, he provides legal guidance to startups, supporting them through their growth and fundraising phases, with a particular focus on compliance and equity crowdfunding. In addition to his corporate role, Mr. Hâncu is dedicated to legal education, frequently serving as a speaker and trainer at seminars and workshops on Law. A graduate of the University of Bucharest, he is also an active member of the Bucharest Bar Association.

Ronald Rapberger is SeedBlink’s regional manager for the DACH region, where he draws on his deep expertise in venture capital, finance, and entrepreneurship. Before joining SeedBlink, he was Chief Investment Officer at Gateway Ventures where he specialized in venture capital co-investments and establishing strategic partnerships across the region. His career began in the biotech industry, where he co-founded a spin-off focused on molecular cancer diagnostics, before transitioning to investment banking, where he spent 12 years in major European financial centers. With SeedBlink, he is focused on expanding the company’s presence in the DACH market, with a strong focus on DeepTech and Life Sciences.

Key Takeaways

- Common Misconceptions in Startup Investments: It is often believed that 9 out of 10 startups fail, but the panel clarified that 1 or 2 startups out of 10 usually succeed significantly. Namely, these startups provide high financial returns, while others may break even or fail, known as ‘walking zombies.’ This concept relates to the Power Law in venture capital, where most of the returns come from a few companies, just as it happens in public markets.

- Risk Management in Startup Investments: The panelists emphasized that risk management is the most critical aspect of investing in startups. They argued that one cannot manage returns, but they can manage risks effectively by diversifying portfolios across different sectors and stages.

- Diversification of Portfolio: It is crucial to diversify investments across phases and verticals to balance risk and opportunities. Early-stage startups pose a higher risk but offer significant opportunities. Conversely, later-stage startups carry less risk but offer fewer returns.

- Avoiding FOMO in Investments: A significant risk in investing is Fear of Missing Out (FOMO). Investors often chase trends, such as the AI boom or e-commerce during the pandemic, which can lead to poor investment decisions when these sectors face downturns. The advice is to avoid focusing heavily on a single trend and spread investments across different industries and sectors.

- AI Hype and Valuation Risks: With examples from the AI industry, the panel discussed how the hype surrounding artificial intelligence can drive investors into a bubble, similar to what happened with e-commerce post-pandemic. They caution that over-investing in AI without diversification could lead to significant risks if the market turns unfavorable.

- Convertible Instruments and Bridge Rounds: When startups need to raise capital between major funding rounds, they often turn to convertible instruments like convertible notes or SAFEs (Simple Agreement for Future Equity). These instruments are popular in down markets, allowing startups to raise funds without determining a fixed valuation. The panel explained that these deals are riskier for investors, but they often come with discounts or valuation caps to mitigate this risk.

- Bridge Rounds Strategy: Given the economic challenges in 2023 and 2024, many startups are opting for bridge rounds to extend their runway until more favorable market conditions return. These rounds are usually funded by existing investors and a few new ones.

- The Shift Toward Profitability: There’s a growing trend among investors pushing startups to focus on profitability instead of pursuing hypergrowth at all costs. This is a departure from the previous mindset of prioritizing top-line revenue growth to increase valuations. Now, investors prefer companies that can sustain themselves even in tough markets by achieving profitability.

- Exit Strategies and Market Cycles: The panel discusses the importance of timing exits in both the private and public markets. Holding onto investments too long in a rising market might look good on paper, but liquidity and real returns matter. The ideal strategy is to exit when the market offers a reasonable return, rather than waiting for an unrealistic multiple.

Insights Based on Numbers:

- 1 or 2 Out of 10 Startups Succeed: This insight challenges the common belief that 9 out of 10 startups fail. While many startups don’t return profits, the key takeaway is that a few winners can bring substantial returns, justifying the portfolio’s entire investment strategy.

- Power Law Drives Returns: The idea that returns are concentrated in a small number of companies, as seen with the top seven companies driving the NASDAQ, highlights the importance of picking winners in startup investing.

- Valuation Caps on Convertible Notes: These instruments include valuation caps, which allow investors to benefit if the company’s next round is at a high valuation, ensuring that they don’t pay inflated prices for their shares.

You are welcome to watch the full recording of the webinar here

Kostiantyn is a freelance writer from Crimea but based in Lviv. He loves writing about IT and high tech because those topics are always upbeat and he’s an inherent optimist!