The post was originally published on the blog Seth Levine.

TBH, I haven’t been thinking much about new investments at the moment. I’ve been asked many times how I think the Covid-19 crisis will change investor behavior and fundraising for startups. I generally give the kind of answer I think most VCs give and say something about how we all know that down markets are great markets for companies to grow (lots of great companies have been started in downturns), that there’s a lot of capital sitting on the sidelines at the moment and that capital will have to be invested, etc. All true, but I think not entirely well thought through in most cases.

For example, I also generally point out that despite most investors saying this, the vast majority are hitting pause on new investments for a bit (say 1-2 months, but who really knows) while they both focus on their existing portfolio and the decisions that need to be made in the near term about cash preservation, PPP loans, etc. and while they evaluate the overall markets and just how deep the crisis will go.

Additionally, as a general rule, funds with larger portfolios are more likely to be on lock-down for new investments. Funds with smaller portfolios are more likely to be looking at new deals.

Everyone is being cautious about valuations. Anecdotally, I’ve heard that early-stage valuations are already down 30-50%. It’s early and not clear where this will end up, but I’ll keep my eye on it and will report here what we’re seeing.

For those of you who are regular readers of this blog, you’ll know that I love data and have several times pulled data from Correlation Ventures (who have a huge proprietary database of venture financings dating back decades which they use to power their investment decisions) in an effort to answer interesting questions about the business and practice of venture capital (my favorite such post is here). Yesterday they put up an interesting post providing some actual data to back up the broader statement that downturns are good markets to invest into (beyond the headlines of great companies that were started in downturns – that’s great but anecdotal; this analysis looks at overall returns post downturn).

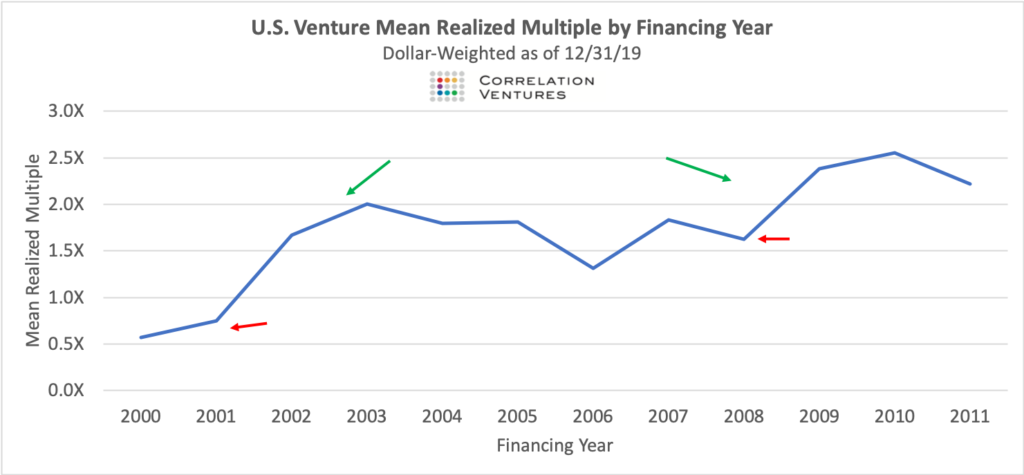

First, the overall trends, which show both a steady increase of returns post the 2000 bubble and show the specific increases post 9/11 and post the 2008 market crash.

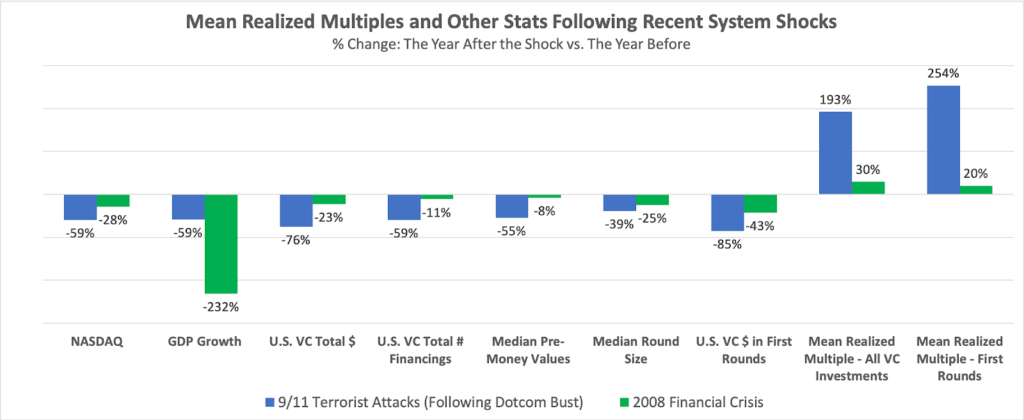

Here’s a bit more detail on investments made the year before each of these downturns and the year after the downturn. Obviously, better to invest after.

For starters, both of these graphs are good reminders that “average” performance in venture isn’t great. That’s always been true, but every time I see a graph like this it does cause me to do a double-take (the graphic below from a recent post I wrote reinforces this). It’s a good reminder of the overall risk of the asset class and, frankly, just how hard it is to generate consistent positive returns (more on that here). But the data are clear that average investment returns increase in the years after a downturn (although part of the lesson here is clearly not to lean in too quickly).

That should make anyone thinking of starting a business feel good. But the same trends that make downturns a good time to start businesses also make it a good time to invest in existing businesses (the Correlation data look at all financing rounds, not just first-time financing).

Access to capital can be tighter (but we’ll see in this case with unprecedented amounts of capital sitting undeployed), but competition for talent is typically reduced. Marketing expenses are lower and customer acquisition costs typically are reduced. Focus can be sharper with fewer market distractions as well as the pressure that comes from having somewhat more limited margins within which to operate. As we emerge from this, it can be your moment.

Markets are always cyclical and although we’re dealing with unprecedented times, the optimist in me knows that over time we’ll dig our way out of this. And that downturns are pretty good times to be building amazing businesses. Stay safe out there.

Seth Levine is a partner and co-founder at Boulder-based Foundry Group focusing on making early-stage technology investments, participating in select growth rounds, and identifying and supporting the next generation of venture fund managers. In addition to his work at Foundry, Seth is active in the global entrepreneurial ecosystem as a founding board member of The Unreasonable Institute, an advisor to Palestinian-focused venture fund Sadara, and advisor to Nairobi-based Ingressive Capital, as well as an advisor and mentor to a number of other venture funds and companies globally. Seth co-founded Pledge 1%, a global network of over 7,000 companies who have pledged equity, time and product back to their local communities. You can find him on Twitter at @sether or at the website.