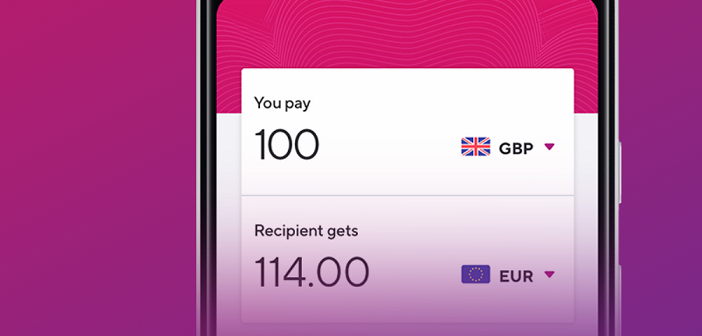

- PagoFX, a money transfer app backed by Santander, has been launched in the UK, enabling transfers among others to Poland.

- Due to the COVID-19 pandemic, the company waives any fees on transfers until June 16.

- The Polish community in the UK is the key segment PagoFX catering to.

Banco Santander S.A., the world’s 16th-largest banking institution and financial services company with headquarters in Madrid, has launched PagoFX in the mid of April 2020. It’s a stand-alone application for international money transfers.

For now, the app allows only UK residents with a debit card issued by any UK bank to send money abroad using their smartphone.

International payments can currently be made in the limited number of currencies from the UK to the US, Eurozone, and some other EU countries, including Poland.

The company plans to introduce further currencies and payment options.

Victoria Yasinetskaya, Chief Marketing Officer at PagoFX & OnePayFX

‘We aim to be present in around 20 countries in the next three to four years, and Poland is definitely in our plan,’ PagoFX CMO Victoria Yasinetskaya told us.

PagoFX responds to the COVID-19.

If you are a resident in the UK, PagoFX allows you to send money abroad at a real-time exchange rate, and until 16th June you won’t pay any fees on transfers up to 3,000 GBP per user. This means that the limit is cumulative – once you submit single or multiple transactions above the 3,000 GBP limit, PagoFX’s standard fees shall apply on all amounts above the limit.

The company is also planning to enable transfers between Poland and Ukraine. ‘Złoty to Ukrainian hryvnia is a corridor we’re looking at when we launch there. The highest inflow of expats in Poland is from Ukraine, which is 47% of foreigners living in the country. Other recipient countries we’re considering are Russia and Belarus,’ stated Victoria Yasinetskaya.

PagoFX vs. One Pay FX

One Pay FX was launched in 2018. The service was designed for the convenience of Santander’s clients exclusively, supporting their international money transfers when made from their Santander account.

PagoFX is the open-market version of One Pay FX so it doesn’t matter who you bank with.

What distinguishes PagoFX from other services?

Naturally, with plans to cover more of European countries, PagoFX provides a direct threat to fintech unicorn TransferWise and other money transfer services.

In its advertising campaign, PagoFX singles out the quite attractive combo – low fees and bank-level security. The company implements cybersecurity, risk, and financial crime requirements.

PagoFX is authorized and regulated by the Financial Conduct Authority (FCA), the UK regulator for financial services firms. This safeguards funds until the associated payment has been sent, so users are fully protected in the case of defective execution of any payment.

Our colleagues from TechCrunch managed to get a comment from PagoFX’s direct competitor, Azimo. ‘It’s great to see a large legacy financial institution moving to give customers a better deal as they play catch-up with the fintech sector. By improving their product and moving prices closer to ours and other digital players they can finally save their customers money at an uncertain time when everyone is watching the pennies and cents,’ Azimo co-founder and Chairman Michael Kent told Steve O’Hear.

Kristo Kaarmann, CEO and co-founder of TransferWise also shared a statement with TechCrunch journalist, saying, ‘Banks and brokers have been misleading customers about the true cost of making international payments for decades, advertising transfers as ‘free’ or ‘0% commission’ then adding a high mark-up on the exchange rate. But there are promising signs that PagoFX signals a more transparent approach from Santander. If so, it’s evidence that the transparency and low-prices we’ve been pioneering are on the way to becoming the new industry standard as customers demand a better service.’

Malgorzata Filipowska, an innovation and fintech specialist at Alior Bank told ITKeyMedia, ‘Due to the specificity of Polish society and the large scale of migration, which may intensify as a result of the coronavirus crisis, applications for international transfers become more and more popular in Poland. The fact that an international bank backs PagoFX will undoubtedly appeal to those customers, who are skeptical about the solutions offered by the existing challenger banks operating on the Polish market such as Revolut or N26.’

PagoFX’s expectations in Poland

According to the company’s management team, Poland is a country to look out for, as fintech is well-integrated into Polish life. According to studies,

- 60% of smartphone users have already been using mobile banking,

- 50% use smartphones to transfer money to friends/family,

- 44% use banks as their main e-commerce method.

‘These are good indicators that the market would embrace a payment solution like PagoFX, which is backed by a highly trusted bank. In terms of our current offer in the UK, Polish zloty has been one of our first receiving currencies from day one, alongside the euro and USD. The Polish community in the UK is a key segment we’re catering to,’ PagoFX CMO Victoria Yasinetskaya shared with ITKeyMedia.