Greater worldwide card use raises some questions. Foremost, do electronic payments bring macroeconomic benefits?

Moody’s Analytics attempted to answer this question by analyzing macroeconomic data for 70 countries between 2011 and 2015. By calculating the impact of card usage on per capita consumption, Moody’s Analytics was able to extrapolate the effect that the increase in spending on goods and services had on consumption and thereby GDP.

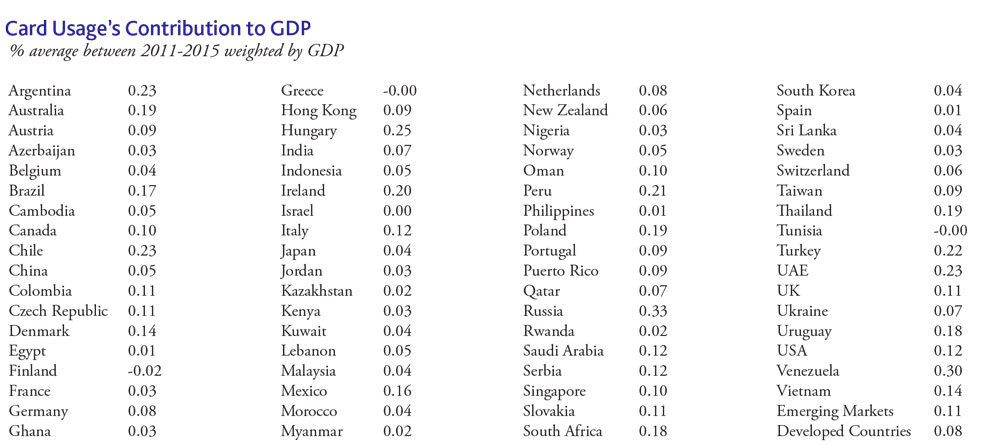

Specifically, Moody’s Analytics estimated that higher card usage contributed an additional $296 billion to consumption between 2011 and 2015, or a 0.1% cumulative increase in global GDP during the sample time period. That equals about a $74 billion contribution to GDP each year. Real consumption grew at an average of 2.3% in the same period, of which 0.01 percentage point is attributable to increased card penetration. This implies that card usage accounted for about 0.4% of growth in consumption, as well as an average increase of 2.6 million jobs over 2011-2015.

Electronic payments added $296 billion in real (U.S.) dollars to GDP in the 70 countries studied between 2011 and 2015. That is equivalent to the creation of about 2.6 million jobs on average per year over the five-year period, or about 0.4% of total employment in the 70 countries.

Countries with the largest increases in card usage experienced the biggest contributions to growth. For example, significant increases in GDP were recorded in Hungary (0.25%), the United Arab Emirates (0.23%), Chile (0.23%), Ireland (0.2%), Poland (0.19%) and Australia (0.19%). In most countries, card usage increased regardless of economic performance.

Only in the case of Finland, Greece and Tunisia did card usage decline when economic performance deteriorated or other macro events affected activity. As a result, consumption was weaker than it would have been had card penetration increased or remained unchanged.

Radio addict, blogger. working on his 1st book ever.