The post was originally published in Russian on Startup of the Day. Alexander kindly agreed to republish what we think is of great value to our readers.

Insurance companies spend significant amounts on checking whether the damage is real. Miracles don’t happen, this leads to worse rates, which additionally scares off the good clients and increases the share of the money spent on fraud fighting. The exact numbers depend on the country and the insurance type, but the problem is common for the industry.

Friendsurance, the German startup of the day, has found a magical solution. It offers its users to unite into small teams of up to ten people. 40% of insurance bonuses of the team members go into the ‘common funds,’ and as long as it’s not empty, the compensations come from there, and checking whether the damage is real is ultimately simplified. Unused remains of the amount are distributed to the users at the end of the year in the form of cashback.

As a result, a potential fraud would be directed at exact living human beings as opposed to the soulless insurance company, it would damage the karma of the potential fraudster and put him under actual real-life risks. Once the limit is over, the standard checks begin, and the possibility that there is work to do is higher – because the limit ran out for a reason.

Technically, friendsurance is registered as a broker, they serve clients of 70 partner insurance companies. The user enters into a regular contract at a regular rate with a third party, and then they address the startup. You can join a team consisting of people suggested by the algorithms, or you can come and bring your friends along, the main condition is that the insurance type was the same, so that there was no apparent disbalance of risks.

Friendsurance boasts about half of those 40% makes it into the cashbacks, and saving 20% seems like an excellent outcome considering no investment. In reality, things seem to be worse. The internet is full of negative reviews, and the statistics is sad: in its 7 years of development, the startup has reached the amount of as few as 100 thousand users. If the issued payments were as good as the ads claim, the whole Germany would be using Friensurance by now, it’s been enough time.

The startup raised its latest round of investment of USD 15M two years ago with the purpose of expanding to Australia. They did open an office there in September – over a year after the announcement, insurance is not a hasty industry. They only insure bicycles so far.

—

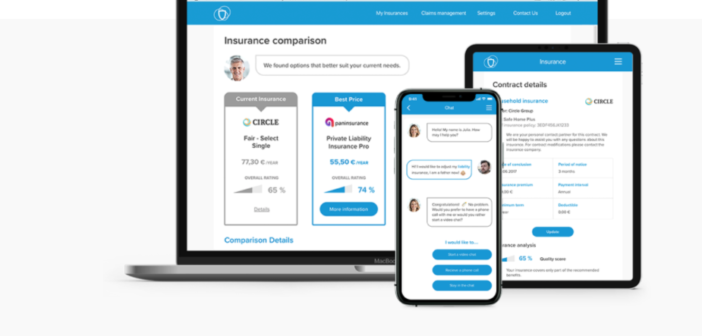

This is a rerun from 2018. The business model never experienced a breakthrough, it keeps working, but it doesn’t turn the world upside down. Meanwhile, the company began developing in an entirely different direction. Now, Friendsurance helps banks and big insurance companies to millenialize their product and add ‘digital experience.’

Translation: Kostiantyn Tupikov

Alexander made his career in Russian internet companies including Mail.Ru, Rambler, RBC. From 2016 to 2018 he was Chief Strategy and Analytics officer in Mail.Ru Group. In this position, he worked on M&A, investments, and new project launches. In 2018 he became Deputy CEO in Citymobil, a Russian Uber-like company that was invested by Mail.Ru Group and Sberbank (the biggest Russian bank), then he left the company to launch his own projects. Now Alexander is a co-founder of United Investors – the platform for co-investments in Russian early-stage startups. His blog #startupoftheday (#стартапдня) is one of the most popular blogs about startups in Russia.