- Sofia-based VC fund Vitosha Venture Partners funded 17 startups that are based in Bulgaria or have Bulgarian founders

- They are looking to invest between 25,000 EUR and 1 mln EUR in over 100 companies

- The fund’s capitalisation is 26 mln EUR

After investing in 17 startups with ties to the Bulgarian market, VC fund Vitosha Venture Partners is looking to finance more than 100 companies by 2024, with tickets of up to 1 million EUR.

“We have invested in 17 companies so far, with tickets ranging from 50,000 EUR to 800,000 EUR (…) With this fund, Vitosha I (which closed at 26 million EUR – editor’s note), our goal is to invest in over 100 companies through 2024″, Max Gurvits, managing Partner at Vitosha Venture Partners, told ITKeyMedia.

He explained that all startups in which Vitosha invests always have a link to Bulgaria, whether it may be the founders’ origin or the startups’ base of operations.

According to Gurvits, Vitosha monitors and works with a pipeline of approximately 100 deals at any given point in time. They are sector-agnostic and are looking for technology-enabled scalable products/ services.

What are they looking for in an entrepreneur? “Grit, ambition, and a propensity to learn and grow. Our main question to founders is always «What else can we do for you beyond the investment?» – and we like to see ambitious answers”, said Gurvits.

Over 5 mln EUR Invested – from Foodtech to Fintech to Micro-mobility

And it seems they have found it in several startups:

- Petmall / 800,000 EUR / pet food and supplies;

- Assen Aero / 600,000 EUR / “hover-motorcycles”;

- Meat Me Bar / 400,000 EUR / protein bars made from meat, dried fruit, nuts, spices;

- OMNIO / 200,000 EUR / financial crime compliance CRM solution;

- Pellet Box / 200,000 EUR / pellet vending machines;

- TokWise / 150,000 EUR / green energy portfolio management;

- FidU Trade / 75,000 EUR / platform for monetising exports at the time of sending goods or performing services;

- Augment / 50,000 EUR / e-sports analytics;

- Bye Bye Stuttering / 50,000 EUR / multilingual stuttering therapy;

- Ecopolytech / 50,000 EUR / biodegradable polymers;

- GridMetrics / 50,000 EUR / energy industry analytics;

- NulaBG / 50,000 EUR / online banking and accounting services for small businesses;

- TraceTheTaste / 50,000 EUR / platform for monetising food and goods that are near expiration.

Total invested: 2.7 million EUR

The following startups were previously part of Vitosha’s portfolio and raised almost the same amount, 2.6 million EUR:

- Hobo / e-scooter rental;

- Quendoo / booking platform;

- Econic One / e-bikes;

- Eirene Studio / luxury fashion.

“Bulgaria is doing exceptionally well. A decade of funding and startup activity is very clearly paying off now in 2021. The country has obvious benefits based on talent, taxation, and EU access, and with all the funding and ecosystem-building that’s been going on, I’d say it’s probably among the strongest in SEE* (with Romania), and on its way to become CEE*-standard in a few years”, Gurvits summed up his take on the market.

* SEE = South-East Europe, CEE = Central and Eastern Europe; editor’s note

According to Vitosha’s Q1 2021 report, European startups have raised 21 billion USD (17.6 billion EUR) in the first three months of the year, out of the 127 billion USD (107 billion EUR) global market, with 27 companies reaching unicorn status.

Bulgaria is doing exceptionally well. A decade of funding and startup activity is very clearly paying off now in 2021. The country has obvious benefits based on talent, taxation, and EU access.

— Max Gurvits, managing Partner at Vitosha Venture Partners

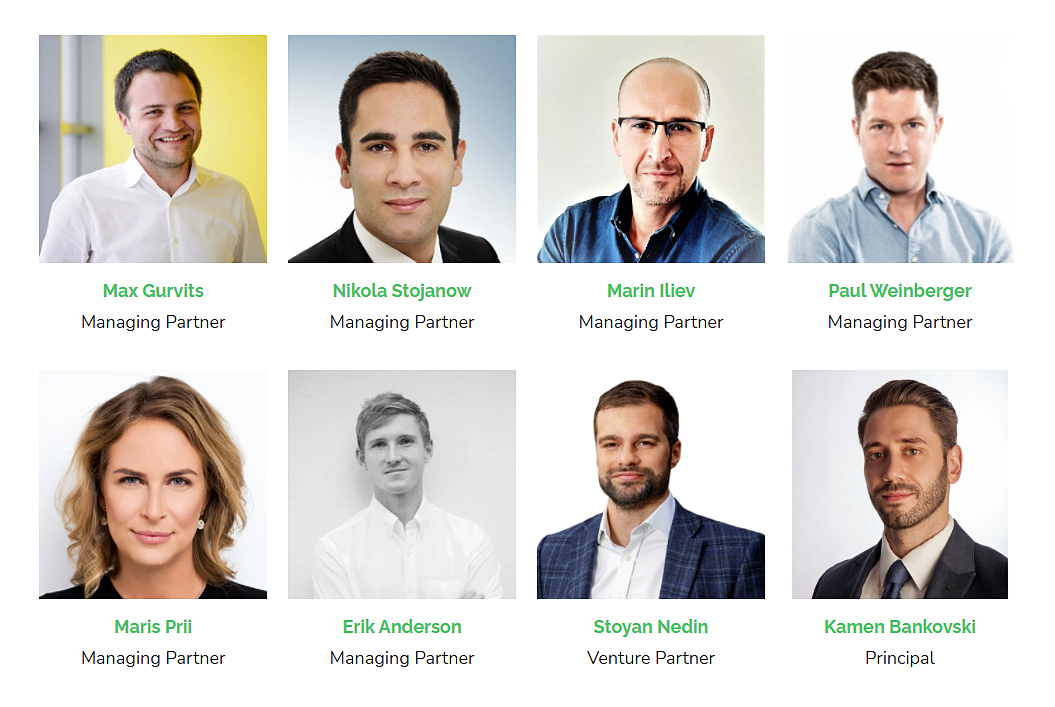

Vitosha was launched at the end of 2020 and is comprised of a team with varied backgrounds and experiences. Gurvits has been active on the Bulgarian market since 2012, after working in the Netherlands, and studying in the US, Italy and the Netherlands. Nikola Stojanow is an advisor for the implementation of blockchain technology in the Bulgarian administration; he also co-founded a company in Liechtenstein and worked in Germany, Serbia, and Hong Kong. Marin Iliev has his name tied to several companies, including NEVEQ Capital Partners, Talk24, eBG.bg, Vereo Technologies, and Rosslyn Capital Partners. Paul Weinberger has his own venture capital/ M&A/ management consulting company since 2010 and has been active in Vienna, Zürich, Luzern, Ruggell (Liechtenstein), and Salzburg. Maris Prii is currently director of business development in the USA for the Estonian Investment Agency and a counsellor for the Estonian Ministry of Foreign Affairs; she was the COO of Startup Wise Guys for four years, where she worked with another Vitosha managing partner, Erik Anderson, who is now venture partner at Tera Ventures from California.

“We all have a long history with each other, in various combinations. Myself and Marin have been on Bulgaria’s venture scene for a decade or more. Erik and Maris have been my business partners for a number of years and we’ve been involved together since they were part of Startup Wise Guys. Paul is an experienced DACH (Germany/ D, Austria/ A, Switzerland/ CH) investor, and Nikola has lots of experience in fintech and blockchain. We’ve all known each other for many years, and our aim with Vitosha was to have a VC operation with a clear and actionable connection to leading markets, in Europe and in the US”, concluded Gurvits.

Vitosha Venture Partners is co-financed by the European Structural and Investment Funds, under the Operational Programme for Innovation and Competitiveness 2014-2020, managed by the Fund of Funds in Bulgaria.

OMNIO Is Looking to Double Its Employees by the End of the Year

ITKeyMedia caught up with Stoyan Lozanov, co-founder and CEO of OMNIO, to share his view from the other side of the negotiation table. The reg-tech startup raised 200,000 EUR from Vitosha and plans to further develop its product, an AI-driven tool for automating financial crime compliance processes.

“Product development is a core aspect of OMNIO’s investment requirement, we will continue to enhance our offering. We are also expanding our client base in other markets and the investment is definitely going to serve in this aspect as well”, Lozanov told ITKeyMedia.

He mentioned OMNIO was in talks with 4-5 other VCs before speaking with Vitosha. “We applied through the form on their website. Although OMNIO was not referred to by anybody, our application was reviewed in less than a week and we got a meeting proposal from the fund (…) Even during the first conversation, Vitosha showed a high level of professionalism and passion that made them stand out. It seemed they were excited to hear answers to questions like «How do you want to benefit society?» and «Who do you want to help?»”, Lozanov recalled.

Asked when OMNIO will make its first million, the startup’s CEO answered “as every enthusiastic founder”, “in the next few months”, but then added that in reality they may be looking to close to one year.

So what kind of expertise does Vitosha bring to the table? Lozanov counteracts immediately with his own question: “It’s safe to ask what kind of expertise does not Vitosha bring to the table?”. He outlined that the fund provides assistance with almost every step of the process: operational aspects, network sharing, business growth, product offering. “With respect to the investment process, they were more than diligent and covered technological, legal & compliance, financial, team and long term vision aspects. Even though there were a lot of things to review, their structured approach made the entire process quick and painless for us.”

It’s safe to ask what kind of expertise does not Vitosha bring to the table?

— Stoyan Lozanov, co-founder and CEO of OMNIO

OMNIO has 9 employees and plans to more than double its team by the end of the year. The startup secured its first two clients before receiving any investments and Lozanov said that their very conservative scenario is at least 15 institutional clients by mid-2022.

Sabin Popescu works as content editor, web designer/ developer and occasionally graphic designer for various companies and institutions across Eastern Europe and was an IT journalist for Romania’s leading business daily, Ziarul Financiar.