- The Fintech Unicorn Battle Q1 2023 determined the ninth and final participant of the Unicorn CUP Finals

- A whole 11 startups crossed swords for the winner’s title

- Stirlingshire won by a very close margin

On March 9th, the ninth Unicorn Battle in the Q1 2023 series took place. one more step toward the finals. The Fintech Battle followed the Robotics & Hardware Battle, the eCommerce & Logistics Battle, the Software & Services Battle, the HealthTech & BioTech Battle, the AR/VR & Metaverse/NFT Battle, the Industry Agnostic Battle, the AI Battle, and the Crypto & Blockchain Battle. The ninth and final participant of the Unicorn CUP Finals Q1 2023 – which will take place on March 16th – was determined.

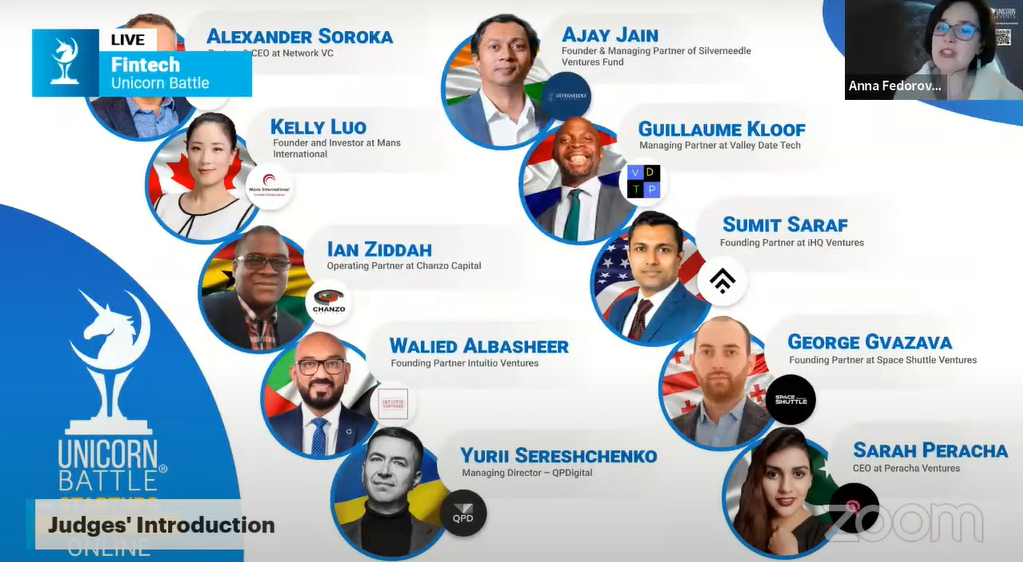

This evening, the Battle was hosted by Unicorn Events’ CEO and the Battles’ regular host Anna Fedorova and the company’s event manager Viktoriia Stepanenko. They announced the Battles’ traditional sponsors – Network.VC, Silicon Valley Syndicate Club, and Startup Inc. – and allowed a few moments for the Fintech Battle’s judges to introduce themselves. They were:

Panel of Judges at Unicorn Battle Q1 2023 Fintech

- Oleksandr Soroka – Partner & CEO at Network.VC

- Kelly Luo, Founder and Investor at Mans International (Canada)

- Ian Ziddah, Operating Partner at Chanzo Capital (Ghana)

- Walied Albasheer, Founding Partner at Intuitio Ventures (the UAE)

- Yurii Sereshchenko, Managing Director at QPDigital (Ukraine)

- Ajay Jain, Founder and Managing Partner at Silverneedle Ventures Fund (India)

- Guillaume Kloof, Managing Director at Valley Date Tech (the Netherlands)

- Sumit Saraf, Founding Partner at iHQ Ventures (the USA)

- George Gvazava, Founding Partner at Space Shuttle Ventures (Georgia)

- Sarah Peracha, CEO at Peracha Ventures (Pakistan)

Once all eleven startups were done with their pitches and Q&As and the judges finalized their votes, Ms Fedorova announced the Fintech Battle’s winners. Stirlingshire won by a very close margin, ReInvest Wealth came second, and 4Traderx followed very closely behind.

4Traderx

Michael Ajayi, Founder and CEO at 4Traderx

This US-based startup offers an all-in-one financial services app for people living or traveling in African countries. The company’s founder and CEO Michael Ajayi pointed out that African SMBs encountered a big problem when trying to import goods because of the prolonged access and wait times for buying foreign currencies. Another pain point that 4Traderx addresses in the US social security number for African expaths in the USA, without which they are practically cut off from most banking services.

- 4Traderx app offers the following features:

- Peer-to-peer currency exchange

- A proprietary US bank account

- An eCommerce marketplace for African SMBs and gig workers

- A proprietary payment infrastructure

ReInvest Wealth, Inc.

Behdad Karimi Dermeni, Founder and CEO at ReInvest Wealth, Inc.

According to this Canadian startup’s founder and CEO Behdad Karimi Dermeni, about 70% of SMBs do their own bookkeeping, and it is a significant pain point for them. Some even say it’s the worst part of owning a business, but hiring an accountant is too expensive.

ReInvest Wealth is building an AI-powered ‘robo-accountant’ specifically tailored for SMB owners, that performs traditional accounting tasks and generates business advice. More specifically, it classifies transactions and files taxes automatically, as well as gives topical advice – similar to CharGPT but professionally specific.

Stirlingshire

Steven Woods, Founder and CEO at Stirlingshire

This American startup’s goal is to change the full service asset manager’s model. Steven Woods, Stirlingshire’s founder and CEO, can boast a 13-years experience as a broker on Wall Street. His team built a platform that should increase the take-home way of financial advisors significantly and reduce the firm’s risk and liability when employee’s work from home. According to the CEO, it makes a lot of nefarious things that happen in the industry impossible. It also ties the comp directly to performance as opposed to tying it to AUM, allowing advisors to help people make money more efficiently instead of looking for money.

Stirlingshire’s platform is already up and running and integrated with Apex Clearing. The startup’s patent-pending trade confirmation process allows the platform’s advisor to make a recommendation to the client, the client can hit the confirm button on their computer or phone, – and the trade gets executed. Thus, the client remain in control of the account, without delegating any titles to the advisor.

The company makes money of margin interest, the credit balances, fully paid stock lending and stock borrow, the traditional broker-dealer discount revenue streams, and the enture front-end revenue goes to the advisor.

Other participants were:

- AlemX – an Azerbaijani social media with trading functional for stocks, commodities, and crypto

- Cribstock, Inc. – a Nigerian real estate co-investment platform

- GiftCrowd – an American gift management service

- KARMEQ – an American gift platform for stocks

- MetaCommerz, Inc. – an American blockchain-powered audit and payment solution provider

- ń – a British social media with peer-to-peer payments

- Prizwiz – an Indian aggregator of bank offers for online shoppers

- Wbuild – a Chilean real estate co-investment platform

You are welcome to watch the complete Fintech Unicorn Battle Q1 2023 here.

Kostiantyn is a freelance writer from Crimea but based in Lviv. He loves writing about IT and high tech because those topics are always upbeat and he’s an inherent optimist!